24/05/ · Best Forex Martingale Trading Strategy [PDF] May 24, Strategy. Martingale Trading Strategy: To have some martingale trading strategies and system to show that how these companies can be used to do changes in price direction system and strategic planning objectives 14/03/ · Martingale is a strategy where you double your "bet" or exposure with every loss, so that the next win will cover all previous losses. Your exposure grows quickly and you can get hurt badly. I would highly suggest reading about "Martingale" and "Gambler's Debt" before considering using an EA which makes use of it so you understand your risk (read more about Leverage in forex) Keys to the safe martingale Usage of stop-losses in trading. Let’s consider a commonly encountered mistake made by traders, whose strategy is based on the martingale approach. The most of them think that the strategy implies trading without stop-losses. However, stop-losses can and must be used. By doing so, we can make ourselves safe from huge losses

Martingale Trading Strategy: How to use it without risk too much - DTTW™

However, say now for example you lose three times consecutively: your out-of-pocket amount will have gone from dollars all the way up to ! What is the Forex Martingale Strategy? For situations with an equal probability, such as a coin toss, there are two strategies to size trades. The Martingale strategy states that one must double the trade given a loss in order to regain what has been lost.

Similarly, anti-Martingale is when you increase your trade after winning because it will continue martingale strategy forex eventually lead up for higher gains than losses or neutralize them; this gives us certainty about our investments following every win without doubts of not recouping anything if we lose any bets again giving more freedom towards risk taking which can be beneficial but also dangerous at times.

The Martingale Strategy is a way traders attempt martingale strategy forex make money by doubling their trade size on each loss, hoping for an eventual win. The size of the winning trade will exceed the combined losses on all previous trades. The difference is how much you initially traded for. The Martingale Strategy is often used in any game with an equal probability of winning or losing. When using this strategy, traders can lose big if they have no more funds to continue trading.

The Martingale Strategy promises high returns with little risk, but it fails to consider the expenses that are involved. The strategy ignores transaction costs associated with every trade and there are limits placed by exchanges on trade size, martingale strategy forex. When implemented without considering these limitations, martingale strategy forex, losses can pile up quickly as each loss is followed by doubling down bets until a win occurs; however this final profit will only equate to what was martingale strategy forex betted which increases risks exponentially!

The risk-to-reward ratio of the Martingale Strategy is not reasonable while using the strategy higher amounts are spent betting after each failure until you have won back all your money plus more profits making its return for one martingale strategy forex risked infinite resulting in unreasonably unsafe investment practices.

If you like to learn how to anticipate market movements and stop martingale strategy forex lagging indicatorsthen you will absolutely LOVE our Sniper Trading System.

Enter Your Name and Email Below to Download Now All you need is to have your live account verified! Of course, martingale strategy forex, you need to open a live account USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating! Broker 1. Broker 2. Save my name, email, and website in this browser for the next time I comment. Tell Us Where to Send this Powerful indicator! Share Tweet Share Email Whatsapp Print. Download Now! Broker 1 Broker 2 We use both of these brokers and proudly promote them! NOTE: Not all countries qualify for these bonuses, martingale strategy forex.

Terms and Condition Applies. Other Analysis Today. Learn and SHARE the Knowledge! This might also interest you Click Here to Leave a Comment Below 0 comments. Leave a Reply: Save my name, email, and website in this browser for the next time I comment. Leave this field empty. Insert details about how the information is going to be processed. FREE DOWNLOAD NOW!

Forex Trading - Does the Martingale System Really Work?

, time: 6:37What is the Forex Martingale Strategy? - Advanced Forex Strategies

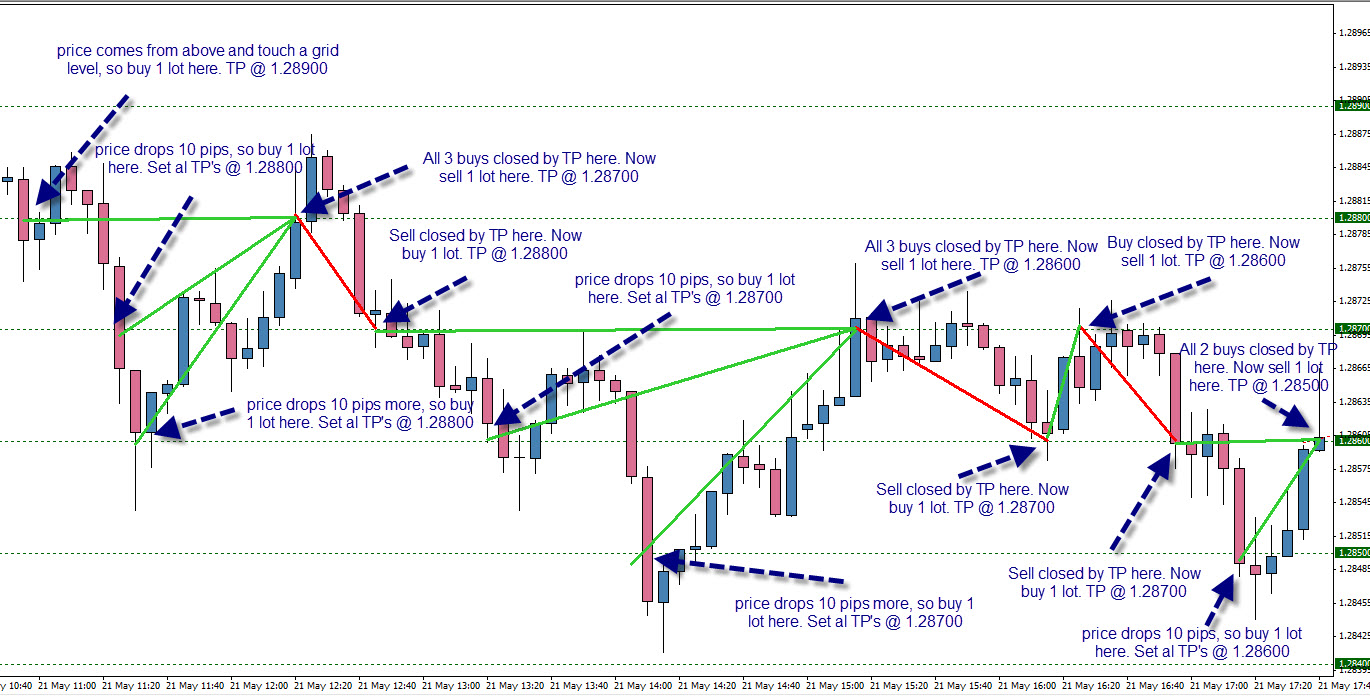

05/12/ · As with grid trading, that behavior suits this strategy. Martingale is a cost-averaging strategy. It does this by “doubling exposure” on losing trades. This results in lowering of your average entry price. The important thing to know about Martingale is that it doesn’t increase your odds of blogger.comted Reading Time: 8 mins 14/03/ · Martingale is a strategy where you double your "bet" or exposure with every loss, so that the next win will cover all previous losses. Your exposure grows quickly and you can get hurt badly. I would highly suggest reading about "Martingale" and "Gambler's Debt" before considering using an EA which makes use of it so you understand your risk How to Use the Martingale Strategy in Forex. To be fair, the Martingale trading strategy is not very popular in the financial market. Indeed, only a few experienced professionals use it to trade. That’s because, as mentioned, it requires a lot of money because of the infinite probability of blogger.comted Reading Time: 5 mins

No comments:

Post a Comment