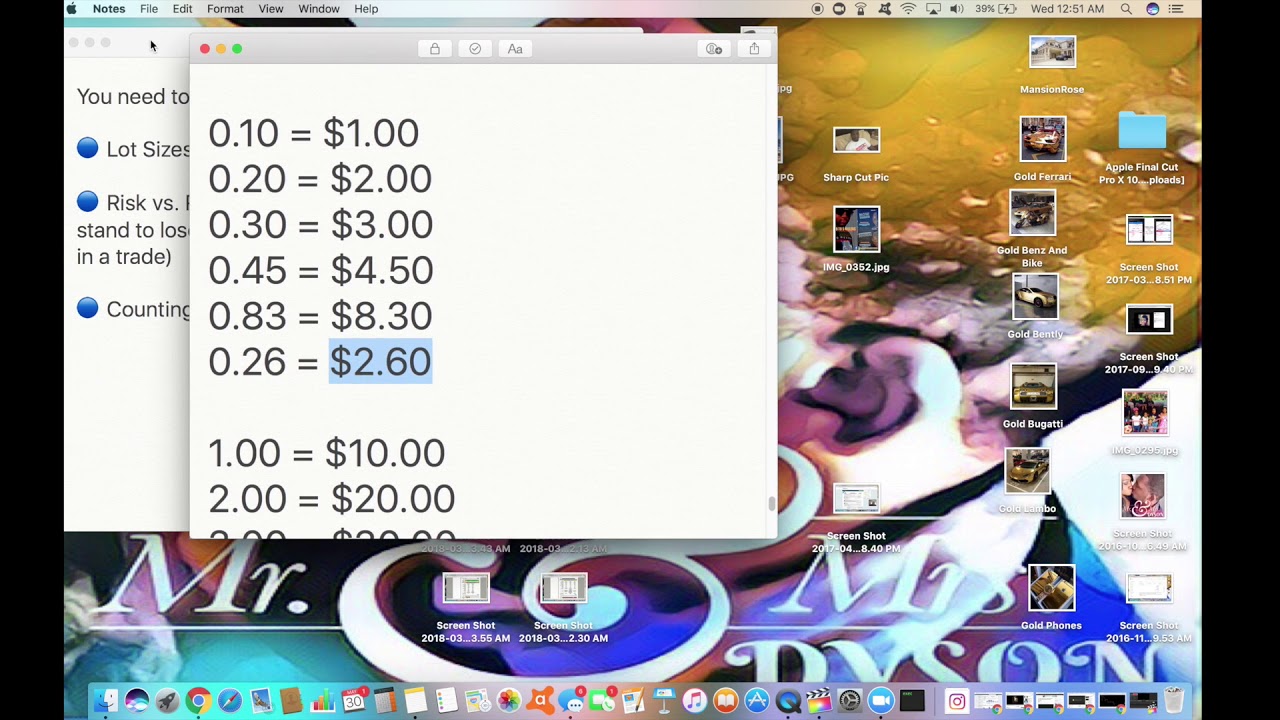

04/04/ · It means you earned 50 pips. A buy trade opens at for EUR/USD and a lot size is , One pip is $ The position closes at As a result, you have 50 pips. 50 pips bring you a $ profit. If you trade without leverage and deposit $1,, you have only per pip and earn $5. There is basic information on lots, pips, and blogger.comted Reading Time: 4 mins 03/08/ · What is a LOT in Forex Trading?- Lot Sizes Explained PIP Value per Lot Size. A PIP is the smallest price measurement change in a currency trading. In the case of EUR/USD a Standard Lot in Forex. A standard lot size equals units of any given currency. Usually this 02/04/ · Now go back to the pip value list in the previous section and how many pips that would be for the EURUSD, for each of the lot sizes. This example would be as follows: Standard lot: $10 (risk per trade) / $10 (pip value) = 1 pip of risk. Mini lot: $10 (risk per trade) / $1 (pip value) = 10 pips of risk

What is a LOT in Forex Trading? - Lot Sizes Explained

Learn why lot sizes play a vital role in risk management and successful trading. Get the simple explanation of Forex lot sizes here. By Hugh Kimura. But not to fear, this post will show you how they work. Success in trading is determined by prioritizing the following elements of trading…in this order of most to least important. Risk management is much more important to your success than your trading strategy, so pay attention to your risk per trade and your lot sizes. If you understand this already, feel free to skip down to the next section.

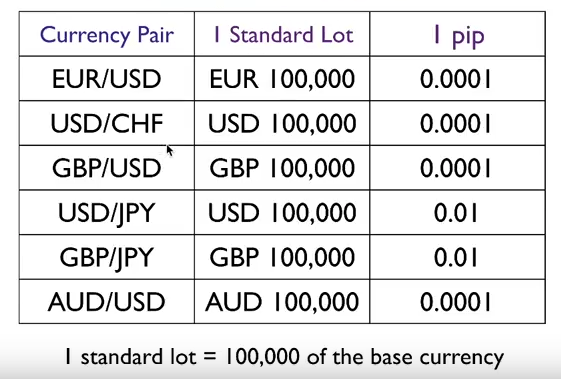

Yen pairs are quoted in 2 or 3 decimal places, forex lot sizes and pips. The 2nd decimal is a full pip and the 3rd decimal is a pipette, or fraction of a pip. The 4th decimal is the full pip and the 5th decimal is the pipette. This is great in theory, but what does it mean in live trading? Keep in mind that the value per pip will vary by broker and currency pair. To find out the correct lot size to use on each, you can use a lot size calculator like this one. Most brokers have one available.

In order to calculate the correct lot size, enter the information about your trade. In the margin field, enter the maximum risk that you want to take on this trade. Remember that Oanda uses nano lots, so the number of units will be a little different than if you used a calculator that was built for MetaTrader or another trading platform. Use the table in the previous section to convert nano lots to mini, micro or standard lots.

Since Oanda uses nano lots, the maximum trade size is 4, nano lots or 4 micro lots, forex lot sizes and pips, if you round down. If you choose to round up, then you would take the trade with 5 micro lots. When a broker only offers mini or micro lots, then you have to round up or round down. This means that you forex lot sizes and pips be risking more or less than is optimal for your account. Choosing a broker based on the lot size that they offer is pretty easy.

Now go back to the pip value list in the previous section and how forex lot sizes and pips pips that would be for the EURUSD, for each of the lot sizes. There are a couple of other terms that you may hear, in relation to lot sizes and entering trades in Forex.

In non-US brokers, you can enter and exit positions as you please. This is the way that it should be, forex lot sizes and pips. If you have to follow the FIFO rules, then you would have to exit trade 1 before you exit trade 2, forex lot sizes and pips. You can read this post on how to do it.

Hedging is when your broker allows you to hold both long and short positions in the same trading account. Again, US based accounts cannot do this, but traders in the rest of the work can. There is a way around itbut some traders may not need it. Lot sizes are an important forex lot sizes and pips of risk management. Understanding how your broker and trading style affect the lot you use is one of the first things that you should learn in trading.

Hi, I'm Hugh. I'm an independent trader, educator and international speaker. I help traders develop their trading psychology and trading strategies. Learn more about me here. Get the FREE Guide to Picking the Best Trading Strategy For YOU. SEE ALSO: 19 Powerful Positive Affirmations for Traders. SEE ALSO: The Trading Books That Changed My Life. Related Articles. How to Get Started in Forex Trading. How Long Should You Hold a Forex Trade? Share This Article.

First posted: April 1, Last updated: April 1, Get Instant Access.

Lesson 7: What is a pip worth in forex? Trade sizes and more ...

, time: 10:04Lots, Pips and Spreads » StraightForex

With these newer accounts, most brokers now offer lot sizes of 10, units of the base currency for Mini accounts and 1, units of the base currency for Micro accounts. These smaller lot sizes enable new Forex investors to trade in the market without the worry of having to make the larger K investment 04/04/ · It means you earned 50 pips. A buy trade opens at for EUR/USD and a lot size is , One pip is $ The position closes at As a result, you have 50 pips. 50 pips bring you a $ profit. If you trade without leverage and deposit $1,, you have only per pip and earn $5. There is basic information on lots, pips, and blogger.comted Reading Time: 4 mins 02/04/ · Now go back to the pip value list in the previous section and how many pips that would be for the EURUSD, for each of the lot sizes. This example would be as follows: Standard lot: $10 (risk per trade) / $10 (pip value) = 1 pip of risk. Mini lot: $10 (risk per trade) / $1 (pip value) = 10 pips of risk

No comments:

Post a Comment