What does MACD stand for? The full name of the indicator is Moving Average Convergence / Divergence. The name is actually a comprehensive description of the MACD forex indicator. It shows the degree of divergence of the MAs. Two EMAs are used for the MACD calculation: fast and slow What is the MACD Indicator? The full form of MACD Indicator is that Moving Average Convergence Divergence. It is atendency for subsequent, tendency for representing progression indicator that identify the connection in the middle of two mode of actions (MAs) of the cost. The MACD was produced by Gerald Appelin the year s MACD is the simplest and very reliable indicators used by many Forex traders. MACD (Moving Average Convergence/Divergence) has in its base Moving Averages. It calculates and displays the difference between the two moving averages at any time

MACD: Ultimate Guide to Use & Read MACD Indicator in Trading | LiteForex

MACD is an acronym for M oving A verage C onvergence D ivergence. After all, a top priority in trading is being able to find a trendbecause that is where the most money is made. The MACD Macd forex is the difference or distance between two moving averages. These two moving averages are usually exponential moving averages EMAs.

In our example above, the MACD Line is the difference macd forex the 12 and period moving averages. The slower moving average plots the average of the previous MACD Line.

Once again, from our example above, this would be a 9-period moving average. The Histogram simply plots the difference between the MACD Line and Signal Line. It is a graphical representation of the distance between the two lines.

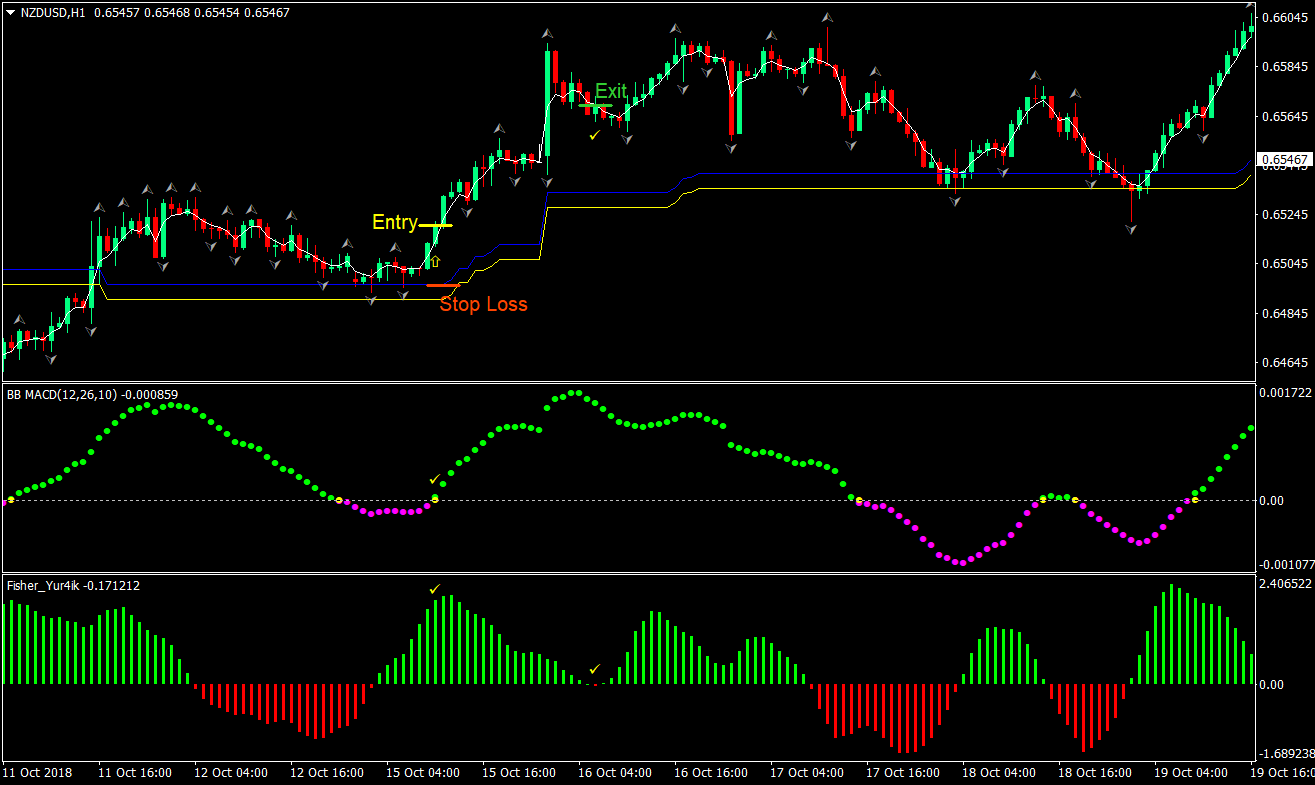

If you look at our original chart, macd forex, you can see that, as the two moving averages MACD Line and Signal Line separate, the histogram gets bigger. As the moving averages get closer to each other, macd forex, the histogram gets smaller. And that, my friend, is how you get the name, M oving A verage C onvergence D ivergence! Whew, macd forex, we need to crack our knuckles macd forex that one! When a new trend occurs, macd forex, the faster line MACD Line will react first and eventually cross the slower line Signal Line.

From the chart above, you can see that the fast line crossed UNDER the slow line and correctly identified a new downtrend. Notice that when the lines crossed, the Histogram temporarily disappears.

As the downtrend begins and the fast line diverges away from the slow line, the histogram gets bigger, which is a good indication of a strong trend.

This suggested that the brief downtrend could potentially reverse. Some men have thousands of reasons why they cannot do what they want to, when all they need is one reason why they can.

Mary Macd forex Berry. Partner Center Find a Broker. Next Lesson How to Use Parabolic SAR.

MACD - Tudo sobre esse indicador - Estratégias de sucesso avançadas no Forex

, time: 24:37MACD | Forex Indicators Guide

What is the MACD Indicator? The full form of MACD Indicator is that Moving Average Convergence Divergence. It is atendency for subsequent, tendency for representing progression indicator that identify the connection in the middle of two mode of actions (MAs) of the cost. The MACD was produced by Gerald Appelin the year s MACD: Ultimate Guide to Use & Read MACD Indicator in What does MACD stand for? The full name of the indicator is Moving Average Convergence / Divergence. The name is actually a comprehensive description of the MACD forex indicator. It shows the degree of divergence of the MAs. Two EMAs are used for the MACD calculation: fast and slow

No comments:

Post a Comment