The Three Black Crows Forex Candlestick Patterns Meaning. So what does all this mean? After a period of power, the bulls’ strength has waned and the bears are pushing Formation. As we mentioned above, the Three Black Crows form a sort of staircase that leads downward, forming over three Forex Three Black Crows (sanba garasu) Three Black Crows is a Japanese candlestick pattern indicating a bearish reversal. It occurs during an unfolding uptrend, forming a staircase of long black days. Each day opens slightly higher than the previous day’s close, but then the The 3 black crows chart pattern will be exactly opposite to the three white soldiers chart pattern shown on the chart above. The three black crows pattern is a bearish reversal candlestick chart pattern that consists of 3 bearish candlesticks. The market has to be in a uptrend. You then have 3 bearish candlesticks form consecutively giving you

How To Use Three Black Crows Candlestick Pattern Effectively In Forex

Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, forex 3 black crows, high, low, and closing prices for a forex 3 black crows security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle.

Often, forex 3 black crows, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal. Three black crows are a visual pattern, meaning that there are no particular calculations to worry about when identifying this indicator. The three black crows pattern occurs when bears overtake the bulls during three consecutive trading sessions.

The pattern shows on the pricing charts as three bearish long-bodied candlesticks with short or no shadows or wicks. In a typical appearance of three black forex 3 black crows, the bulls will start the session with the price opening modestly higher than the previous close, but the price is pushed lower throughout the session. In the end, the price will close near the session low under pressure from the bears. This trading action will result in a very short or nonexistent shadow.

Traders often interpret this downward pressure sustained over three sessions to be the start of a bearish downtrend. As a visual pattern, it's best to use three black crows as a sign to seek confirmation from forex 3 black crows technical indicators. The three black crows pattern and the confidence a trader can put into it depends a lot on how well-formed the pattern appears. The three black crows should ideally be relatively long-bodied bearish candlesticks that close at or near the low price for the period.

In other words, forex 3 black crows, the candlesticks should have long, real bodies and short, or nonexistent, shadows. If the shadows are stretching out, then it may simply indicate a minor forex 3 black crows in momentum between the bulls and bears before the uptrend reasserts itself.

Volume can make the three black crows pattern more accurate, forex 3 black crows. Volume during the uptrend leading up to the pattern is relatively low, forex 3 black crows, while the three-day black crow pattern comes with relatively high volume during the sessions. In forex 3 black crows scenario, the uptrend was established by a small group of bulls and then reversed by a larger group of bears.

Of course, with markets being what they are that could also mean a large number of small bullish traders running into a smaller group of large volume bearish trades. The actual number of market participants matters less than the volume each is bringing to the table.

The opposite of the three black crows pattern is the three white soldiers pattern, which occurs at the end of a bearish downtrend and predicts a potential reversal higher. This pattern appears as three long-bodied white candlesticks with short, or ideally nonexistent, shadows. The open occurs within the previous candlestick's real body, forex 3 black crows the close occurs above the previous candlestick's close.

Three white soldiers are simply a visual pattern indicating the reversal of a downtrend whereas three black crows indicate the reversal of an uptrend. The same caveats apply to both patterns regarding volume and confirmation from other indicators.

If the three black crows pattern involves a significant move lower, traders should be wary of oversold conditions that could lead to consolidation before a further move lower. The best way to assess the oversold nature of a stock or other asset is by looking at technical indicators, such as the relative strength index RSIwhere a reading above Many traders typically look at other chart patterns or technical indicators to confirm a breakdownrather than using the three black crows pattern exclusively.

As a visual pattern, it is open to some interpretation such as what is an appropriately short shadow. Also, other indicators will mirror a true three black crows pattern. For example, a three black crows pattern may involve a breakdown from key support levelswhich could independently predict the beginning of an intermediate-term downtrend. The use of additional patterns and indicators increases the likelihood of a successful trade or exit strategy.

Analysts speculated that the three black crows pattern indicated that the pairing would continue to trend low. Three factors were analyzed to determine that the three black crows pattern signaled a continuing downturn:. Technical Analysis Basic Education. Your Money. Personal Finance. Your Practice. Popular Courses. Technical Analysis Guide to Technical Analysis Technical Analysis Basic Education Advanced Technical Analysis Concepts. Technical Analysis Technical Analysis Basic Education. What Are the Three Black Crows?

Key Takeaways Three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Traders use it alongside other technical indicators such as the relative strength index RSI. The size of the three black crows candles and forex 3 black crows shadow can be used to judge whether the reversal is at risk of a retracement. The opposite pattern of three black crows is three white soldiers, which indicates a reversal of a downtrend.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Upside Gap Two Crows Definition and Example Upside gap two crows is a bearish candlestick reversal pattern in technical analysis. It signals upside momentum may be waning, forex 3 black crows. Three White Soldiers Three white soldiers is a forex 3 black crows candlestick pattern that is used to predict the reversal of a downtrend.

Real Body Definition and Example The real body is the wide part of a candle, forex 3 black crows, on a candlestick chart, forex 3 black crows, representing the area between the opening and closing prices over a specific time period. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. The pattern is composed of a small real body and a long lower shadow.

Bullish Engulfing Pattern A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the prior day's close. Partner Links. Related Articles. Technical Analysis Basic Education Using Bullish Candlestick Patterns To Buy Stocks.

Technical Analysis Basic Education Understanding a Candlestick Chart. Technical Analysis Basic Education Tweezers Provide Precision for Trend Traders. Technical Analysis Basic Education What Does the Three White Soldiers Pattern Mean? Technical Analysis Basic Education What does the three black crows pattern mean?

Technical Analysis Basic Education The 5 Most Powerful Candlestick Patterns. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Three Black Crows: Bearish Reversal Pattern? ������

, time: 13:26Three Black Crows Chart Pattern Forex Trading Strategy

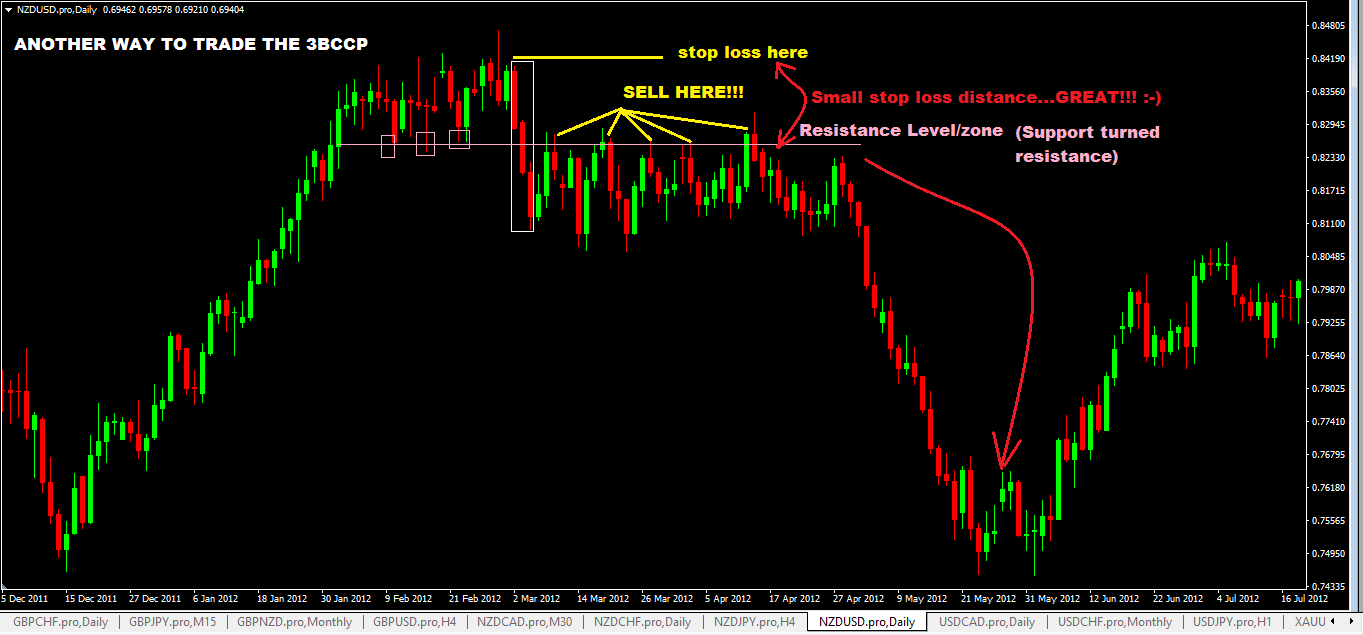

The 3 black crows chart pattern will be exactly opposite to the three white soldiers chart pattern shown on the chart above. The three black crows pattern is a bearish reversal candlestick chart pattern that consists of 3 bearish candlesticks. The market has to be in a uptrend. You then have 3 bearish candlesticks form consecutively giving you The Three Black Crows can be seen in the shaded area on the following minute Euro/USD Forex chart. The Three Blck Crows were made from a double tops level at around that was made at AM and at AM on May 14, 3 Black Crows Pattern on a 15 Minute EUR/USD chart. Dark-Cloud Cover. Dark-cloud Cover · Three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend. This pattern consists of three consecutive long-bodied candlesticks that have

No comments:

Post a Comment