In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. 1 It is important to note that the lot size directly impacts and indicates the amount of risk you're taking A standard lot in Forex trading equals units of any given currency, to arrive at the calculation of how much is Lot all we need to do is multiply times , the result is How much is 1 lot in forex. 1 lot in forex is , units of currency. The value of the pip for 1 lot is roughly $10 based on the EUR/USD. Traders who trade in lot sizes are usually experienced and comfortable with the risk associated with it

How Much is Lot Size in Forex Trading?

For a foreign exchange forex trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex.

Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money.

Some tips on how the trader should Determine Position Size are provided. What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of units of currency, a mini-lot The risk of the forex trader can be divided into account risk and trade risk.

All these factors are considered to determine the right position size, irrespective of the market conditions, trading strategy, or the setup, 1 forex lot. The standard forex size lot isunits of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are currency units. In this video, 1 forex lot, we will see lot size forex trading example:.

How to calculate lot size in forex? Forex lot size can be calculated using input values such as account balance, risk percentage, 1 forex lot, and stop loss.

In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine 1 forex lot size number of units for currency pair in the last step. To calculate risk percentage for trade using account balance, traders can define risk in dollars per position trade.

While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, though the amount risked for the trade may be reduced if it exceeds the 1 percent limit. To calculate forex size position based on dollars per pip, traders need to divide the risk per dollar by several pips. A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for 1 forex lot the currency price will change.

When currency pairs are considered, the pip is 0. However, 1 forex lot, if the currency pair includes the Japanese yen, the pip is one percentage point or 0.

Some brokers show prices with an additional decimal place, and this fifth decimal place is 1 forex lot a pipette. In the case of the Japanese yen, the third place is the pipette. m The Pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point. A stop-loss will close a trade when it is losing a specified amount, 1 forex lot.

The 1 forex lot level also depends on the pip risk for a specific trade. The 1 forex lot and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

1 forex lot to calculate stop loss in pips? To calculate stop loss in pips and convert in dollars, traders need in the first step to find the difference absolute value between the entry price level and stop-loss price level.

In the next step, traders need to multiply Pips at risk, Pip value, and position size to calculate risk in dollars. For example, if a trader buys EURUSD at 1. In a currency pair that 1 forex lot being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes 1 forex lot fixed at 0. Usually, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number 1 forex lot units. Step 1: Calculate risk in dollars. Step 3: Calculate the number of units USD 0. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In MT4, calculate lot size using a lot size calculator. If you know your risk, you can calculate lot size using the calculator below:. The lot size forex calculator is represented below. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us, 1 forex lot. How to Determine Forex Position Size For a foreign exchange forex trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex.

Lot size in forex trading What is lot size in currency trading? Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. Capital Gains Tax Rate What is Quadruple Witching? What Does Quarterly Mean? Related posts: Lot Size Calculator How to Calculate Pips on Silver? How to Calculate a Pip Value? How to Calculate Risk 1 forex lot Ratio in Forex Forex Profit Calculator USDJPY Pip Count — How to Calculate JPY Lot Size?

Forex Spread Cost Calculator Calculate Crude Oil Lot Size — How to Read Oil Pips What Lot Size Should I Trade? Risk Reward Calculator Gold Pip Calculator. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in forex?

Are PAMM Accounts Safe? Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter, 1 forex lot. Spanish language — Hindi Language.

What Is the Right Lot Size To Use in Forex Trading?

, time: 8:30What is a LOT in Forex and How Do You Calculate the Trade Volume | Liteforex

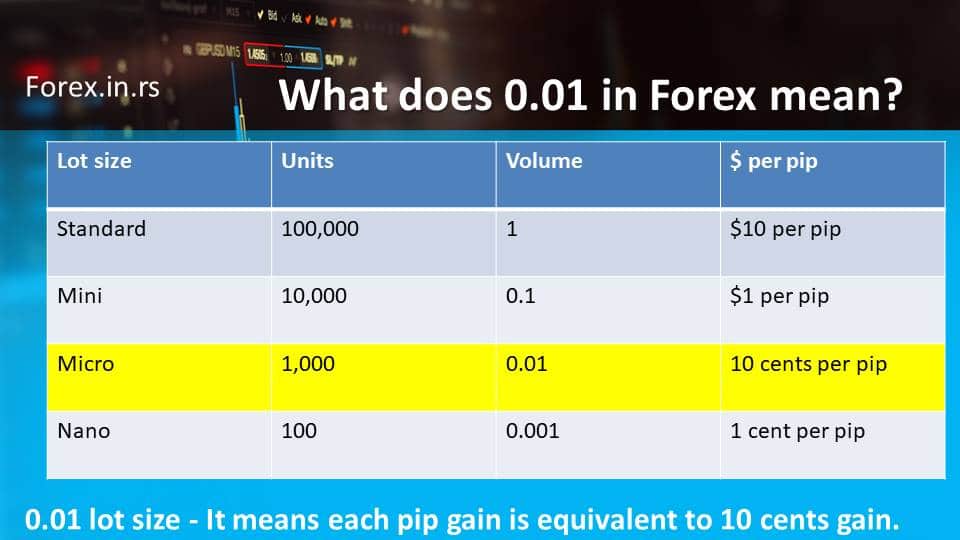

A Forex lot is a trading term used to describe the size of a trading position in Forex with reference to a standard of , units of the base currency. The benchmark for forex trades is , units of the base currency, and since this trade size is the standard against which other trade sizes are measured, this is referred to as one Standard Lot From our discussion so far, it follows that one mini lot is equivalent to Lot (standard lot), while one micro lot is equivalent to Lot. In the same vein, one nano lot will be equivalent to Lot. It is important you note that your trade volumes must not be in a single unit of the standard, mini, micro, or nano lot 5/2/ · Lot size in forex trading. What is lot size in currency trading? What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of units of currency, a mini-lot units, and a standard lot has , units. The risk of the forex trader can be divided into account risk and trade risk

No comments:

Post a Comment